Disclaimer: The introductory APR offer and terms were current at the time of this publication. Always check with your card issuer prior to making any material business decisions. The information provided in this article are for educational purposes only, and I cannot be held liable for any losses or damages incurred.

When I first started my business, I put in $20k in cash as an initial investment. I figured this was a reasonable and decent amount of money that would help me get started with some initial expenses like a laptop computer, as well as an initial batch of inventory.

After using up most of the initial $20k to purchase initial batches of inventory, sales started coming in, but not as quickly as I would have liked. I ended up running into an issue many businesses face: tying up most of my cash in my inventory. This wasn’t an immediate concern, because I knew that my conversion rates and sales would increase in the long run, but I wanted to purchase even more inventory to expand my product offerings, and I wanted to do it immediately.

When the business is profitable but you’re short on cash

At this point, one obvious solution was to invest more of my personal money into the business in order to purchase more inventory. This would have required me to find a significant chunk of cash, which I didn’t immediately have available, and I also didn’t want liquidate my other savings and investments so that I could put more into this business.

I also didn’t want to get friends or family involved, and also didn’t want to go through the hassle of a small business loan.

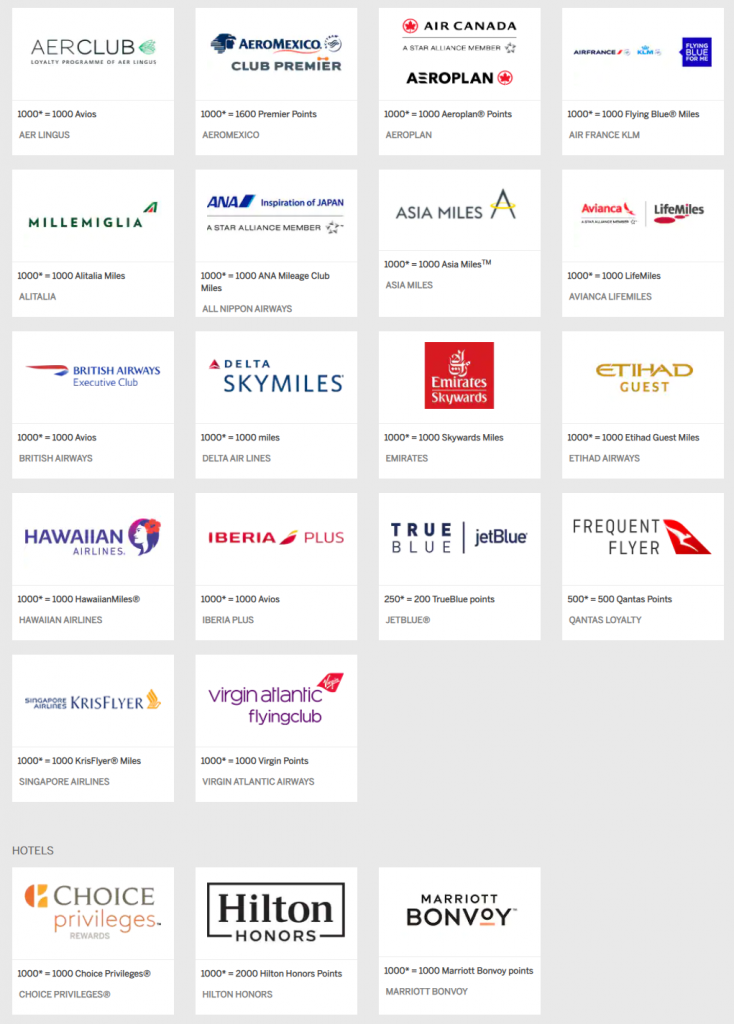

Luckily, while searching for a new business credit card, I stumbled upon a very valuable offer for the Blue Business Credit Card from American Express. I initially found this credit card because it offers 2x Membership Rewards for every dollar I spent on my business. Since I was expecting my business expenses to grow as the business expanded, I knew that this was a great way to earn rewards while spending on my business.

What I didn’t notice until later was that the credit card offered an introductory 0% APR on purchases for the first 12 months. In plain English, this meant that I could choose not to pay back the balance on my credit card for 12 months, and I wouldn’t incur any interest or fees on those purchases. In short, a free loan that could help me grow my business!

I am extremely wary of using credit cards to borrow money, as the interest rates are extremely high. On my personal credit cards, for example, I always pay my balance in full every month, and never spend more than I can afford to immediately pay back. Many consumer credit cards will use similar “introductory APR” language to lure customers in, only to have them pay hefty interest and fees once the customers rack up a large balance that they cannot pay off.

So, a bit skeptical, I called American Express to confirm that I could truly get an interest-free loan. The representative confirmed that this was indeed the case – as long as the balance was paid in full at the end of the 12-month period, I would not have to pay any interest charges. If I did have a remaining balance at the end of the 12-month period, however, I would be liable for interest charges that would have accrued during those 12-months.

With this confirmation, I decided that it made sense for me to use the interest-free loan on the credit card. Instead of paying back the balance in full every month, I would be able to keep that cash and use it to purchase more inventory. It was, however, absolutely essential for me to be able to pay off the balance in full within the first 12 months. I promised myself that I would only spend money that I knew I could pay back before the first 12 months was up.

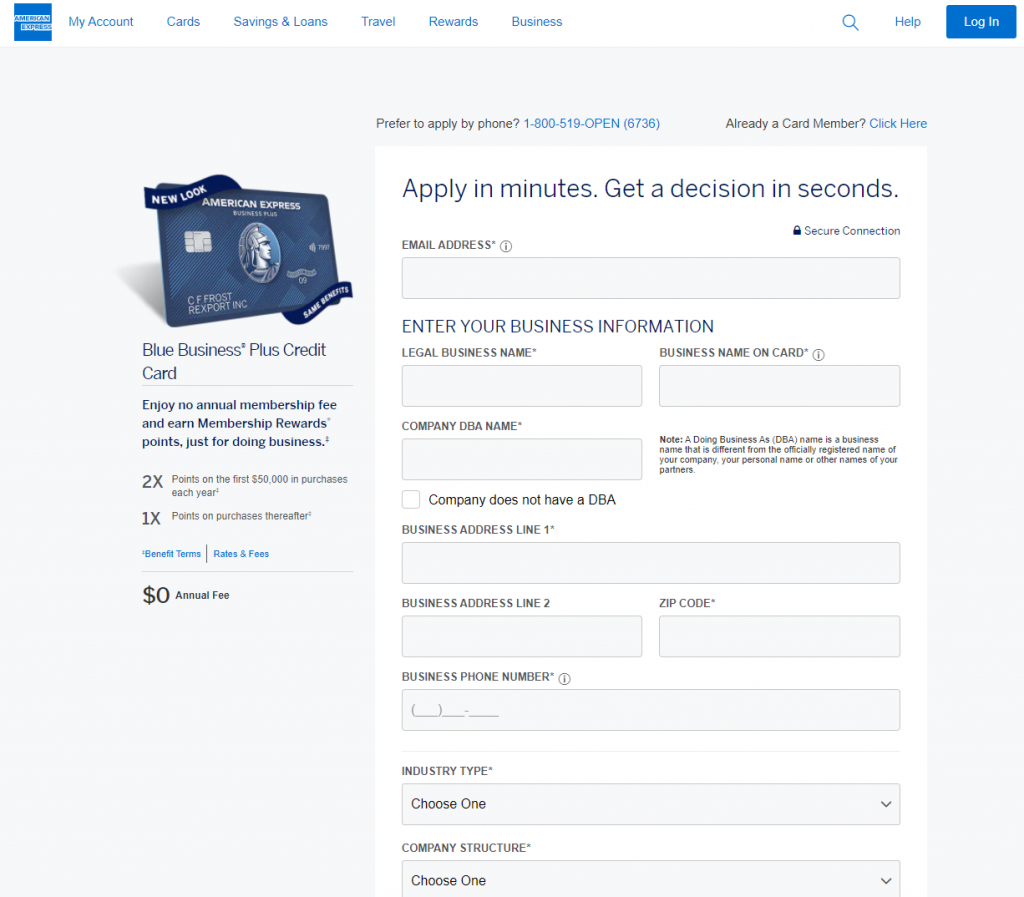

Applying for the American Express Blue Business Plus credit card

I applied for the credit card, and filled out my business and personal information. In addition to basic details like the business address and contact information, I was also asked to provide my business’ EIN as well as personal SSN. (One thing to note is that the application form will note that they will hold the applicant personally liable for debts if the business becomes insolvent. This is an important caveat and I explain this further at the end of the article.)

After reading some other disclosures and clicking the submit button, I was approved instantly with a credit limit of $35k! This basically meant a loan up to $35k, which had no interest as long as it was paid back within a year.

Once I started making purchases, I quickly reached the $35k credit limit. I could have simply stopped using the credit card, and made sure I had $35k ready to back back within a year. Instead, I made a serious effort to pay down the balance as much as I could, and paid the balance in increments of $10k every time I made enough sales.

I did this for two reasons. First, I wanted to reduce the balance on the credit card as much as possible, because not being able to pay off the balance within 12 months was simply a risk I did not want to take. That’s because of the way the introductory APR works – if you pay it all off within 12 months, you won’t owe any interest, but if you fail to pay any part of the balance, you’ll be hit with 12 months worth of interest that you would have been charged without the introductory promotion. That’s a lot of interest!

The second reason was that I wanted to continue making purchases on the credit card so that I could continue to earn credit card rewards points. Once my credit card balance hit my credit limit, I was unable to make any more purchases, which meant that I was unable to earn rewards points on my business expenses. By making payments to bring down the credit card balance, I was able to continue to make additional purchases on the card, and this would allow me to earn more credit card rewards points.

The amount of cash coming into my business was very minimal in the early months. However, I was able to spend significantly more on inventory early on, and growing my product offerings by having the additional $35k to spend. It did take me until the end of the year for my sales to “catch up” with my inventory purchases, but I was able to successfully grow my business to the point where I was bringing in $40k+ per month in sales. Had I not had access to the extra cash to spend on growing my product line, my revenues would most likely have been half of what they were at the end of the year.

As my sales grew, I was able to generate enough free cash flow each month to pay off the balance in full, and I have been able to pay credit card balance in full every month. Although the introductory interest-free period was just a temporary benefit, I continue to use the credit card for purchases to earn the 2x Membership Rewards points.

Personally Liable for Debts

One important thing to note is that for a new business with no established credit, it is almost impossible to be approved for a credit card without agreeing to have the business owner be personally liable for the business debt, should the business become insolvent. In other words, if my business had completely failed, American Express could come after me personally, and force me to pay back the debts out of my personal assets.

In my case, I was comfortable knowing that I would be able to pay back any of the business debts out of my personal savings in a worst case scenario. If you do go this route, however, I strongly recommend being prudent with your business purchases, and be prepared to pay for it out of your personal savings if your business fails.

Will A Credit Card Loan Help Your Business?

Credit cards can be very dangerous and detrimental if used irresponsibly, and this is also the case for business expenses. While each business situation is unique, I would recommend asking yourself some of these questions before pulling the trigger.

- Why do you need more cash? Is it truly something that will help you grow your business?

Almost all businesses could use more cash, especially those that are just starting out. But it’s very important to know why you need the cash, and whether or not it will truly help you grow your business. It’s easy to categorize many purchases as “investments,” but not all purchases will yield the same results.

For example, you might hear people calling AdWords or Facebook ads an investment. I personally don’t think this is an investment in most circumstances, but rather a marketing expense on which you either immediately make a positive return on or not. For a new business, I think the increase in brand value from “Facebook fans” is negligible.

For an ecommerce business, I can’t really think of any worthwhile investments other than inventory. If you find yourself justifying your purchase as an investment, be careful not to trick yourself into thinking an expense is an “investment.”

- Is your business fundamentally profitable?

If your business is not profitable, you will not be able to pay back any loan without taking on another loan. I strongly recommend against taking out any kind of loan unless you have been able to prove that your business is profitable. In simple terms, this means that your cost of manufacturing, shipping and marketing the product is less than the price you charge your customer.

Assuming your business is profitable, the only reason you should take out a loan is due to a timing issue. In my case, because my business was fundamentally profitable, I could have simply waited several months to get the cash in my checking account. It made sense for me to use the credit card loan because I knew the money was coming, it was just a matter of time.

Your business should never depend on a loan to survive, rather, it should be used as a boost that helps accelerate your growth.

- What are the chances you will not be able to pay the balance in time?

You should always be prepared for things to not work out as you had hoped. When taking out a credit card loan, be prepared for the worst case scenario, which would be a complete business insolvency. If this happens, can you afford to be personally liable for the debts?

Even if your business doesn’t completely fail, sales may fail to grow or even decline. If this happens, are you able to afford not paying off the balance in time, and being charged significant interest and fees? While I had a 12-month period in which to pay off the balance, I made a conscious effort to pay it off in half the time, in case things didn’t go as well as I had expected. I was able to do it just 5 months, but I recognize that I was fortunate. Had my business not grown enough for me to generate more cash, I may have needed all of the 12 months to get it paid off.